Immutable Transaction History

Bitcoin's permanent, tamper-proof record makes altering transaction history computationally infeasible.

Forensic Detectability

Blockchain analysis enables investigators to trace fund flows with certainty impossible in traditional finance.

Real-time Public Dashboard

Citizens verify sovereign holdings continuously without relying on periodic government reports.

Multi-signature Authorization

Transactions require cryptographic approval from multiple keyholders—unilateral spending becomes impossible.

Protected Whistleblower Channels

Cryptographic mechanisms protect whistleblower identity while enabling verification of claims.

Cryptographic Fund Segregation

Distinct addresses for distinct mandates provide publicly verifiable evidence against commingling.

Settlement Efficiency

Direct peer-to-peer settlement removes intermediaries, eliminating costs and corruption opportunities.

Time-locked Restrictions

Spending constraints enforced cryptographically with supermajority override for genuine emergencies.

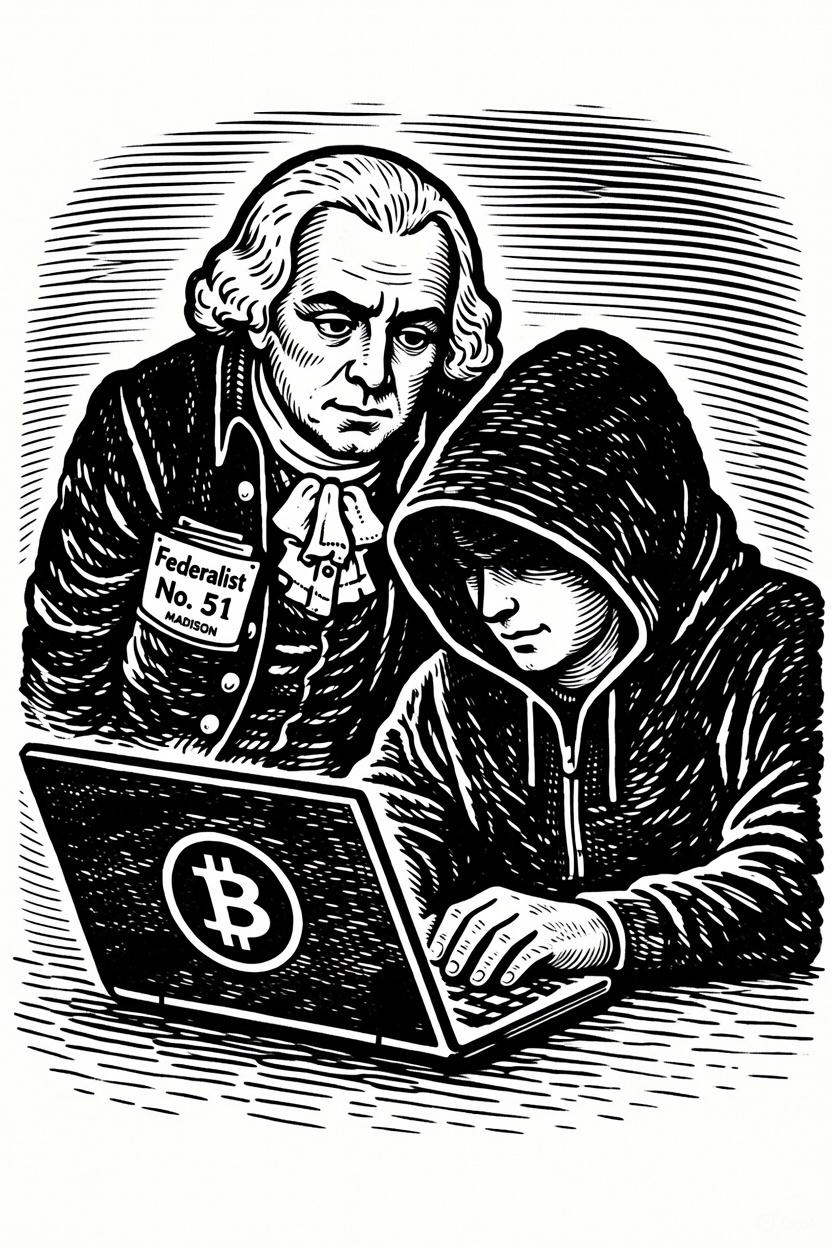

"If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary."— Federalist No. 51, 1788